We wanted to help by providing customers with a simple and easy way to understand how the company is financed and where their water and sewerage bill payment goes.

We held a co-creation workshop with customers to show them how this document could look. But thanks to their participation, they told us they would prefer a bill breakdown explanation with their annual bill, and for the rest of the detail to be housed online.

So welcome to Our Finances Explained section of the website –

co-created by you, our customers.

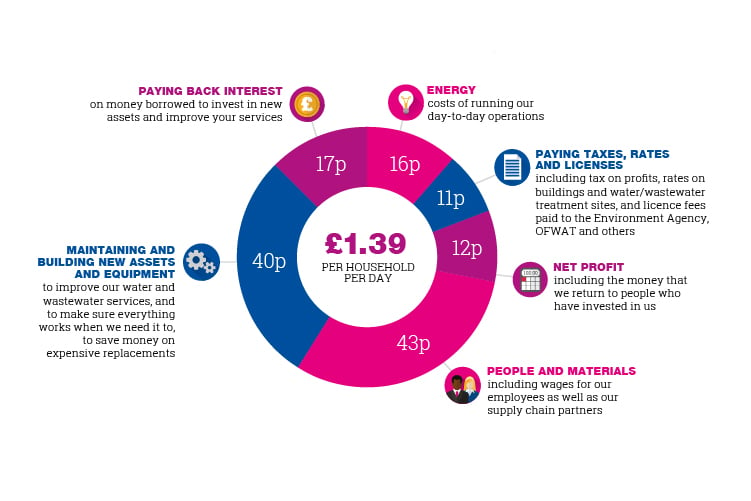

NORTHUMBRIAN WATER

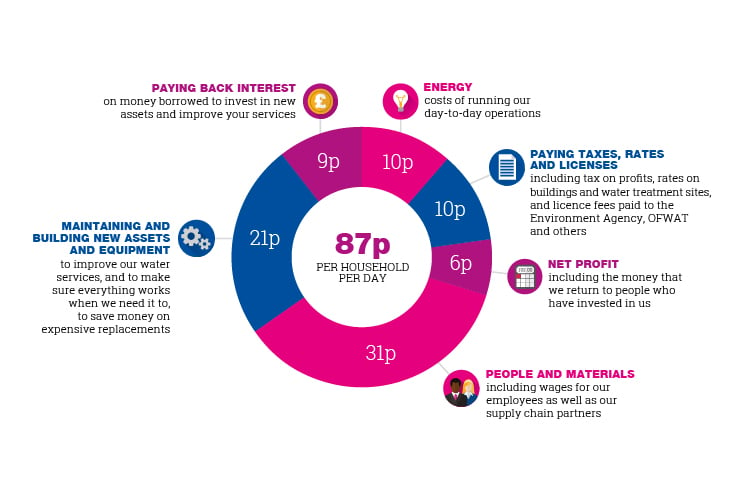

ESSEX & SUFFOLK WATER

Our aim is to be national leader in water and sewerage services, today but also tomorrow, and it is really important that we are clear about how we do this.

The funding and financing of our business is a central part of this. We employ thousands of people either as employees or through our supply chain partners to make sure we can deliver the best service we can for our customers, investing millions of pounds to build new assets to support this. It’s our responsibility to fund this as efficiently as we can on behalf of all our customers and stakeholders. With these sums involved, combined with the whole host of legislation and regulation we must follow, it’s understandable that the financing arrangements of water companies sometimes appear complex.

|

Like most companies, we are financed through a combination of money from shareholders, profits and by borrowing money. |

|

We are majority owned by companies in Hong Kong who are responsible and committed investors in our business. |

|

Like any investors, our shareholders expect a return on the money the put into our business but these dividends are not guaranteed. We make sure the dividends are set at a level which is sustainable, remains consistent with our investment grade credit ratings and allows us to continuously put money back into the business. |

|

Our executive director pay and benefits package is structured to attract and keep people of a high calibre but also reflects how well we are performing. |

|

Our immediate holding company, NWGL, is based in the UK and pays corporate tax to the UK Government. |

|

Our independent non-executive directors set us challenging targets and give support in their areas of expertise to our Board. |

|

The Independent Challenge Group (ICG), which we call The Water Forum, have a very clear role to challenge us on behalf of our customers and give Ofwat (our regulator) an unbiased view of how well we listed to customers and out them at the hear of our decision making. |

Our customers are at the heart of everything we do and we set our water and sewerage charges to reflect the costs of continuing to deliver the safe, clean and reliable water that our customers expect, as well as what is needed to remove and treat wastewater efficiently.

Once every five years a significant, industry wide, exercise is carried out with the water regulator, Ofwat, which sets our price controls for the next five year period. This exercise is known as a Price Review and we are currently in the process of agreeing our plans for 2025-30 more details can be found here.

We review our charges in detail annually to make sure they are set fairly so that customers only pay for the services that they use.

In addition customer affordability is very important to us. We make sure no customer group experiences a high increase in their charges from one year to the next as the impact of inflation is also incorporated into bills. We also have many ways to help customers who may use higher than average amounts of water, due to their particular circumstances, as well as helping some customers to reduce arrears and re-schedule payments to ease debt problems. We constantly encourage customers who may be struggling with household bills to take the first step and talk to us, as there is a number of ways we can help.

Further details on support available can be found here – Essex & Suffolk Water customers / Northumbrian Water customers.

We keep our bills as low as we can through a combination of:

- Being efficient with how we deliver water in order to keep customers’ bills low by using treatment works with lower running costs and always looking to drive down unnecessary costs. We are the first water company in the UK to use all the sludge remaining after sewage treatment to make renewable energy.

- We also seek to finance our operations efficiently – we borrow money where interest rates may be fixed for many years to make sure we have a stable financing base.

- We invest heavily to deliver reliable and high quality supplies and improve the services we deliver for our customers, and again we seek to do this as efficiently as possible.

- Finally, the way we manage our taxes helps to also make sure we can deliver the lowest possible bill for customers.

The services we provide are essential to life and wellbeing, and it is important to us that our customers should always have complete trust and confidence in what we do. We want our service to be recognised as unrivalled, delivering what our customers consider to be good value for money.

Asset

An item of property owned by a person or company. For a water company this can be our network of pipes, treatment works and reservoirs.

Bond

A type of long-term borrowing.

Capital allowances

An expenditure that a UK business may claim against its taxable profit (eg. spending money on buying equipment). The allowance may be deductible in one year or over several, allowing companies to delay payment of corporation tax until a time when the level of investment reduces.

Capital contribution

The amount of money or assets invested in the business by the owners. The capital contribution increases the owner’s equity interest in the company.

Capital investment

The money invested in assets to enable a company like our to deliver services to customers.

Dividends

The sum of money paid regularly (typically annually) by a company to its shareholders out of its profits or reserves.

Interest

The money paid at a particular rate for the use of money borrowed.

Investment grade credit ratings

Is the quality of a company’s credit and shows if they are a low risk of a credit default, making it an attractive investment.

Principal intermediate holding companies

Companies between the ultimate parent company and the operating company.

Profit

The amount of money left over once the costs associated with running the business are taken into account.

Revenue

All incoming money received by a company, often through charges or bills.

Shareholders

A person or company that legally owns one or more shares in an organisation.

Tax

A amount of money a company is required to pay to the government on any profit made from business activity.

We always aim to be as clear and straight forward as we can be and further details of our finances and the important work we are doing for our customers can also be found in Our commitments to you,

Financial Statements, and our Annual Performance Report.

Our finances explained

- We receive revenue from the bills we issue to our customers for providing water and sewerage services in the North East of England as Northumbrian Water and water only services in the South East as Essex & Suffolk Water.

- The cash we collect from bills funds the running of the business and operations – roughly £1.16 per household per day for Northumbrian Water customers (for water and wastewater services) and 77p per household in Essex & Suffolk (water only services).

- We add to this by raising either cash from banks and debt markets.

- This cash is then used to support our large investment programme and fund the building of new assets.

- We pay interest on the debt borrowed.

- This, combined with our significant investment programme, influences how much tax we pay.

- The remaining cash after paying tax and all our other expenditure is our profit.

- We reinvest some of this profit in the business and an element is paid as dividends to our shareholders.

Some of our customers have been surprised in the past to learn that while we make a profit each year we also have a high level of debt within the business. This arises as we do not charge customers every year for the full cost of the investment being made. These costs are spread out fairly over a long period of time to match the period of their expected use, so that the cost of investment is shared by both the customers of today as well as tomorrow.

We invest around £1m per business day in improving our services for our customers. We boost the money from our customers through their bills by borrowing money from banks and debt markets.

We issue bonds to the debt markets and pay for some of our investments by short-term bank loans (less than five years) until we build up enough new debt to allow us to convert into a longer term bond issue. Our bonds are mainly publicly listed on the UK Stock Exchange and are sold directly to pension funds and other large institutional investors to who we pay interest each year.

The bonds benefit from our investment grade credit rating which helps reduce the rate of interest we pay, making sure our financing costs stay as efficient as possible for customers. These credit ratings (given to us by experts) let us obtain financing at the most competitive and attractive interest rates, and the benefits of low funding costs flows into customer bills.

By keeping our debt well-balanced we are able to effectively manage risks of changes to inflation and interest rates and keep customer’s bills stable. Our total borrowings at 31 March 2023 amounted to £3.63bn.

Another big cost to the business are taxes and regulatory costs.

We are open and honest about our tax arrangements and publish our

Tax Strategy on our website.

Contributing to society through tax payments is a cornerstone of our responsibility. Further details on our total tax contribution can be found in our Understanding tax report.

Our Business Plan includes an allowance for the corporation tax we expect to pay, just like any other operating cost. The plan contains our estimate of tax payments that reflect the benefit of tax reliefs that are available to us and known future rates of tax. This helps us to keep the cost of customers’ bills down.

We pay corporation tax on our profits after taking into account reliefs that are available to all companies under the UK tax system.

The calculation of our taxable profits includes deductions for interest on our borrowings, capital allowances on money we invest in improving our infrastructure networks, and tax losses made available to us by other group companies. Tax is paid in four instalments annually based on the current tax charge in our Financial Statements.

The capital investment we make brings benefits to our regions. Every year we invest around £480m in our communities and is a significant factor in determining how much tax we pay not and in the future. The capital allowances system helps save the company tax in the present, but it will result in tax being paid in the future.

The profit we generate is driven by how efficiently we can run the business to deliver our commitments for our customers. After deducting operating costs, financing costs and tax from our revenues we are left with our profit. Profits can be either given to shareholders or and reinvested back in the business.

Our shareholders have provided all the necessary capital and financial backing required to run the business and in return they receive a dividend return on the capital they have invested. The dividends we can pay are driven by our financial and operational performance, the level of service provided to our customers, and employee’s interests, so the returns our shareholders receive are not guaranteed from one year to the next. There are many significant risks associated with the business. Shareholders, rather than customers, carry the weight of these risks.

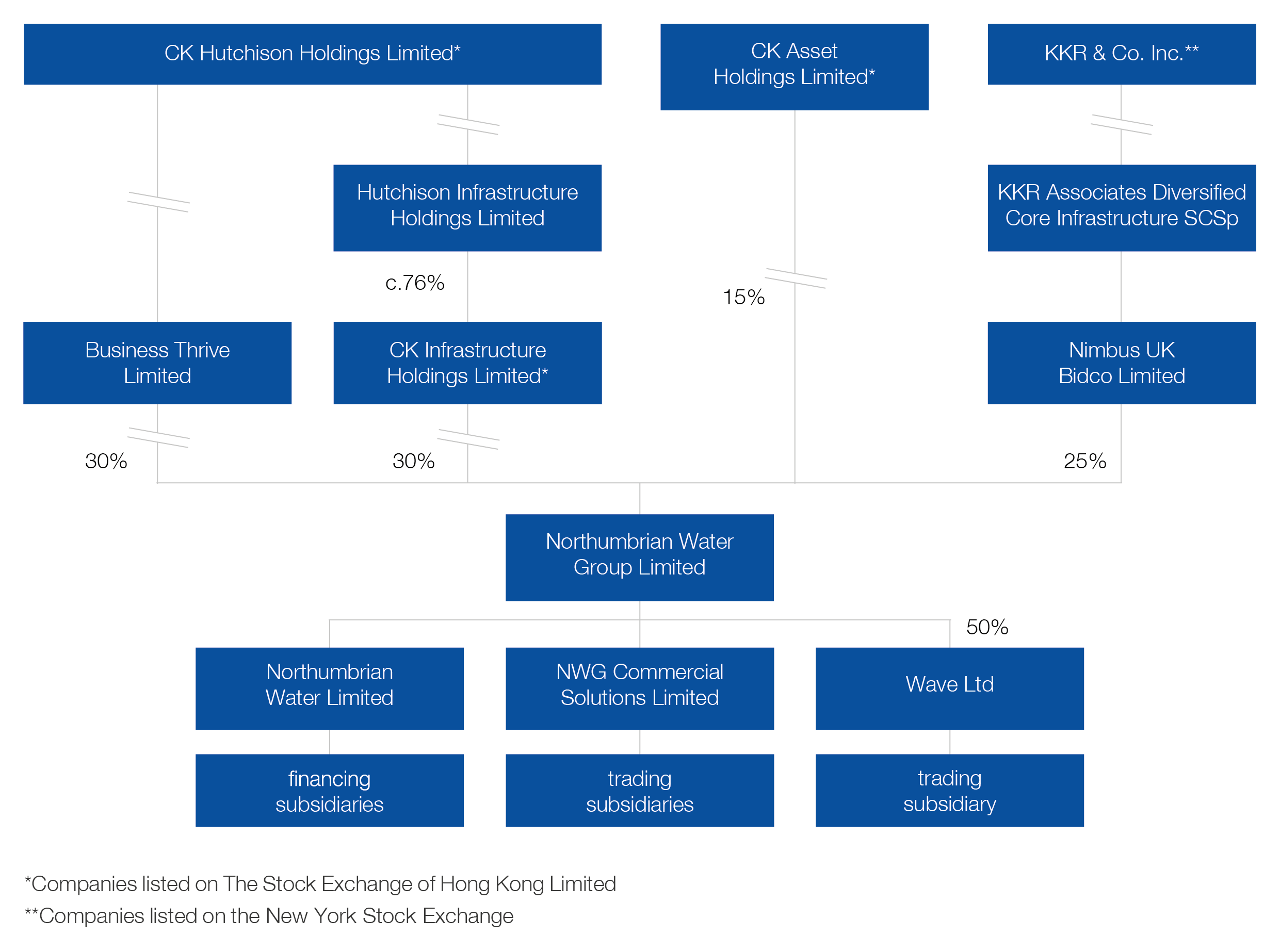

We make sure the dividends are set at a level which is sustainable, remains consistent with our investment grade credit ratings and allows us to continuously put money back in the business. Northumbrian Water Limited (NWL) is one company within the wider

Northumbrian Water Group Limited (NWGL) Group. NWGL is owned by three shareholders:

- CK Infrastructure Holdings Limited

- CK Asset Holdings Limited

- KKR & Co. Inc.

The value of the dividends we pay shareholders are agreed by the Board to take into account how well we are performing against a range of targets.

Similarly, the Board also considers how well we are performing against our commitments to our customers and our budget performance. When all of these have been taken into account the level of dividends are agreed.

The Remuneration Committee oversees the amount of money that is paid to executive directors and senior management.

The decisions that are made are around what is paid to new directors, and the bonuses and long term incentives that are paid to senior management. It is important that the right balance is struck by attracting and keeping talent, ultimately with customers’ interests at heart. To strike this balance, executive directors have annual and longer term targets relating to customer service, performance and sustainability, alongside personal targets. The amount they receive is dependent on their performance in all of these areas.

We are a wholly owned subsidiary of Northumbrian Water Group Limited (NWGL).

NWGL has one other direct subsidiary, NWG Commercial Solutions Limited, which acts as a holding company for other non-regulated trading companies. NWGL also owns 50% of a joint venture company, Wave Ltd. which, through its trading subsidiary, carries out Nonhousehold (NHH) retail activities in England and Scotland

The chart below shows the summarised corporate structure of the Group. The chart shows the principal intermediate holding companies, which are wholly owned unless otherwise shown. On 22 December 2022, KKR & Co. Inc. indirectly acquired a 25% shareholding in NWGL on a prorata basis from NWGL’s three other shareholders. CKHH, CK Infrastructure Holdings Limited (CKI), Business Thrive Limited, KKR & Co. Inc., KKR Associates Diversified Core Infrastructure SCS, Nimbus UK Bidco and NWGL have provided Ultimate Controller undertakings to the Company in accordance with the provisions of the Company’s Instrument of Appointment (Licence).

The chart shows the principal intermediate holding companies, which are wholly owned unless otherwise shown (the percentage values represent the economic interests).